CHILDCARE CHOICES AND ELIGIBILITY FOR GOVERNMENT FUNDED EARLY EDUCATION

Funded places available at Wyndham Park Nursery School

Many working parents of 2 to 4 year olds in England are eligible for 15 hours of 'extended' free childcare in addition to the 'universal' offer for 3 and 4 year olds of 15 hours. At Wyndham Park Nursery School we offer both the 15 and the 30 hours (for eligible parents) of free early education in school term times. This means we are able to offer full time places.

Not every child will be eligible for the funded 30 hours or 2 year old entitlement hours but everyone will still receive the 15 hours free childcare for 3 and 4 year olds.

How do I know if I’m eligible?

You need to meet the eligibility criteria before you can claim 15 hours funded childcare. Working parents in England who each earn more than £8,670 - equivalent to at least £167 per week or 16 hours at the National Minimum Wage - but less than £100,000 adjusted net income per year, will be eligible.

Eligibility is calculated on an individual basis rather than by household. This means if you have a partner, you must both individually earn between these two amounts. If you, or your partner, are on maternity, paternity, or adoption leave, or one of you is unable to work because you are disabled or have caring responsibilities, you could still be eligible.

You (and your partner if you have one) must have a national insurance number, and at least one parent (the one who is making the application) must have at least one of the following:

• British or Irish citizenship

• settled or pre-settled status, or you have applied and you’re waiting for a decision.

• permission to access public funds - your UK residence card will tell you if you can’t do this. Parents already receiving some additional forms of government support, such as Universal Credit, working tax credits or child tax credits, can also receive 15 hours of fully funded early education, including childcare, for 2 year olds, separate from the new entitlement for working parents.

How do I apply?

You apply online using a government gateway account. If you do not already have an account, you will need to open one. Log in: Government Gateway Account

You’ll need to make sure you have the following information to hand before starting the application:

• your national insurance number (or unique taxpayer reference if self-employed)

• the date you started or are due to start work

• details of any government support or benefits you receive

• the UK birth certificate reference number (if you have one) for your child.

You may find out if you’re eligible straight away, but it can take up to 7 days. Once your application has been approved, you’ll get a code for funded childcare to give to us as your childcare provider. This will be an 11 digit code. Parents will be asked to reconfirm that they are still eligible for the support every 3 months. Login to your childcare account to renew. Your code will have an expiry date, for when your eligibility ceases. This may be less than 3 months, if you have more than one child or claim Tax Free Childcare, as renewal dates are often aligned.

What if I’m already registered for Tax Free Childcare?

Parents must reconfirm that they are still eligible for Tax-Free Childcare at least every 3 months. As applications are now open for the new working parent entitlement, when eligible parents reconfirm they will receive a code which will also enable them to access the new offer.

To provide reassurance to parents with reconfirmation windows in late February and March, HMRC is taking additional steps to ensure every parent is able to give their code to their provider in good time. If your reconfirmation window opens on or after the 15 February, HMRC will send you a letter with a temporary code before this date. The letter will also explain how to use your code to claim your free place in April. Where possible, please wait for your letter to arrive.

You don’t need to contact HMRC. Before your letter arrives, you can speak to your provider and use your eligibility for Tax-Free Childcare to demonstrate your eligibility for the working parent entitlement, as the eligibility criteria are the same. You can do this by showing your provider: • Proof of your Tax-Free Childcare eligibility (this can be a screenshot from your childcare account, or simply showing your account to your provider) • When your reconfirmation window is (you can get this from your childcare account) • Your National Insurance number, and • Proof of your child’s date of birth, for example your child’s birth certificate, to show they turn 2 on or before 31 March 2024. However, you must wait for your code (either via letter or through your regular childcare account) to formally confirm your free place.

My child turns 2 or 3 after 1 April. Why aren’t I entitled to free childcare?

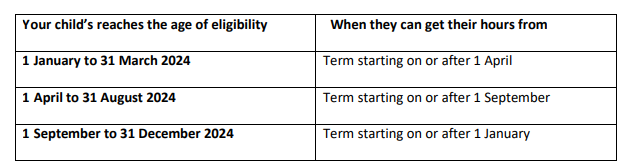

We do not set the rules, we have to follow the Government guidance and even if you have a code the code can only be used for eligibility as follows:

Your child’s reaches the age of eligibility When they can get their hours from

1 January to 31 March Term starting on or after 1 April

1 April to 31 August Term starting on or after 1 September

1 September to 31 December Term starting on or after 1 January

Please remember that even if the code says it is valid you have to receive it before the term starts so if you receive a code on 31st March you could use it in Summer term from the 1st April. However, if you receive a valid code on 1st April you will not be able to use it until the next term (1st September) so it is really important you apply for a code ahead of time.

Useful resources:

Eligibility Criteria: https://www.gov.uk/check-eligible-free-childcare-if-youre-working

To Appy and renew eligibility: https://www.gov.uk/sign-in-childcare-account

Childcare Choices parent web page: https://www.childcarechoices.gov.uk/

Childcare Service Helpline: https://www.gov.uk/government/organisations/hm-https://www.gov.uk/check-eligible-free-childcare-if-youre-workingrevenuecustoms/contact/childcare-service-helpline

Childcare Service telephone: 0300 123 4097 – if you are having any issue obtaining or renewing a code contact the parent helpline.

Early Years Entitlements Team (Lincolnshire County Council): EYE@lincolnshire.gov.uk